How can financial institutions

enable RBI-backed

CBDC payment solutions?

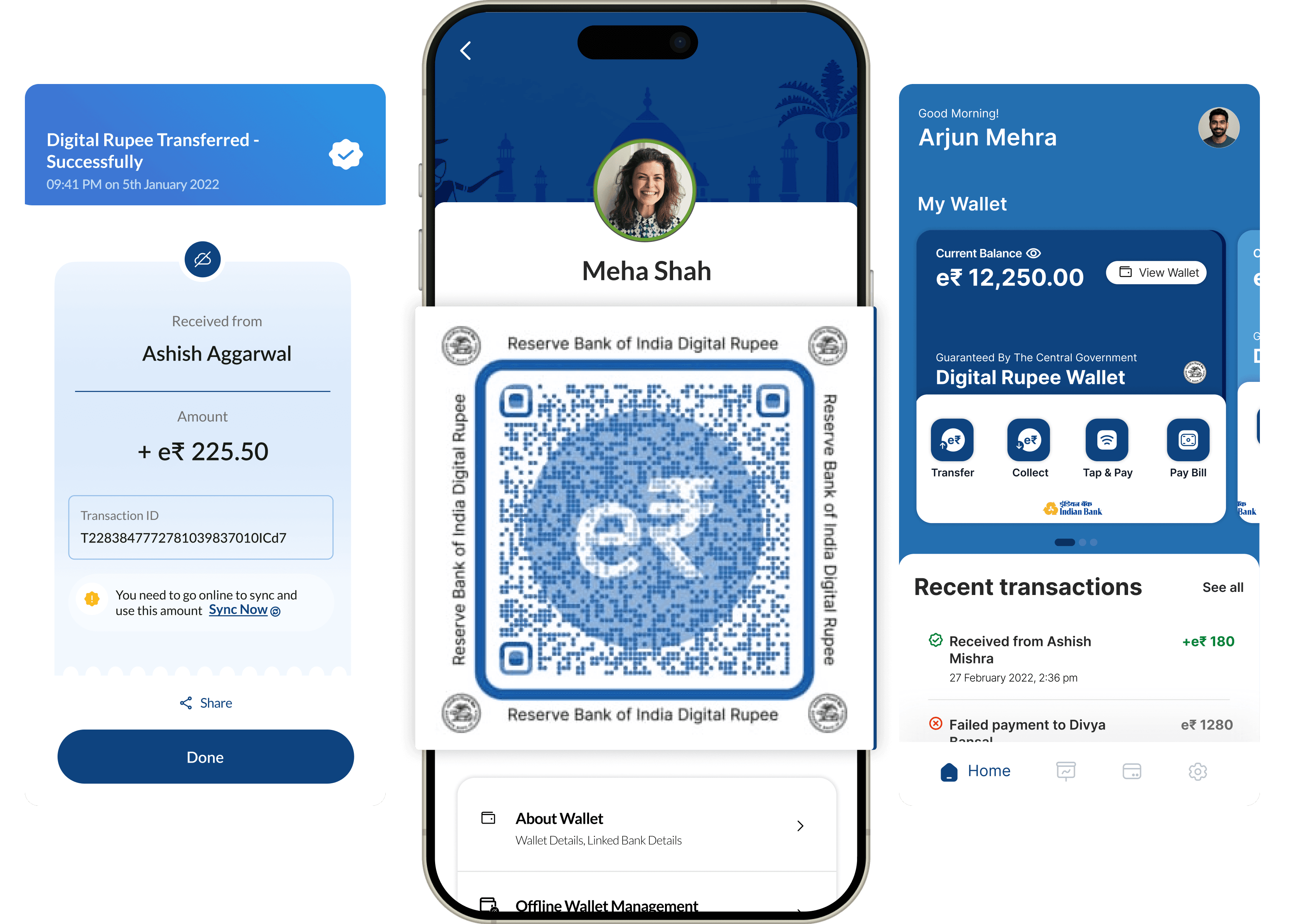

Digiledge CBDC

With Digiledge’s CBDC solution, we empower financial institutions to seamlessly enable Central Bank Digital Currency acceptance across payment touchpoints. Built for interoperability and regulatory alignment, our API-first stack helps institutions stay ahead of evolving RBI digital currency mandates, offering faster settlement, reduced transaction costs, and an omnichannel payment experience.

Key Features

Tap into new revenue streams through CBDC-enabled transactions

Drive merchant retention with digital rupee capabilities.

Accelerate GTM with ready-to-deploy payment solutions

Business Impact

Tap into new revenue streams through CBDC-enabled transactions.

Drive merchant retention with digital rupee capabilities.

Accelerate GTM with ready-to-deploy payment solutions

Why Choose Us

Be an early mover in digital currency adoption with Mintoak’s blockchain-powered CBDC stack. Fast, secure, and cost-efficient, it enables new revenue streams and enhances your merchant offering.

Tap into new revenue streams

Launch Digital Rupee at scale

Stay future-ready with blockchain

Explore Products